Materiality considers economic, social and environmental matters that can influence the Bank’s ability to create sustainable value. All such aspects must be taken into consideration during the formulation of any strategic directions or priorities.

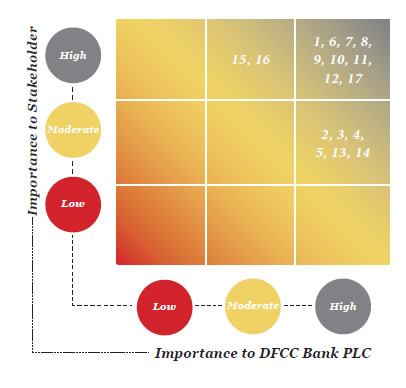

These aspects are analysed from the perspectives of importance to our stakeholders and importance to the Bank. An aspect is considered to be material if it is both relevant and significant. Significance takes into account the magnitude of the impact as well as the likelihood of its occurrence.

As per the materiality analysis, we have identified the aspects that are of importance to stakeholders and of importance to the Bank in the context of our economic, social and environmental agenda for sustainable value creation. For the ease of focus and analysis, the aforementioned have been mapped on the two-dimensional matrix featured below as per the GRI G4 Sustainability Reporting Guidelines.

The insights derived will aid us in charting our course for sustainable value creation.

| No. | Category/ Aspect |

| Economic | |

| 1. | Economic performance |

| 2. | Indirect economic impacts |

| Environmental | |

| 3. | Energy |

| 4. | GHG emissions |

| 5. | Products and services |

| Social: Labour Practices and Decent Work | |

| 6. | Employment |

| 7. | Occupational health and safety |

| 8. | Training and education |

| 9. | Diversity and equal opportunity |

| 10. | Equal remuneration for women and men |

| 11. | Labour practices grievance mechanisms |

| Social: Human Rights | |

| 12. | Non-discrimination |

| Social: Society | |

| 13. | Local communities |

| 14. | Anti-corruption |

| Social: Product Responsibility | |

| 15. | Product and service labelling |

| 16. | Marketing communications |

| 17. | Customer privacy |

Prudent execution of a mindfully-mapped portfolio of strategies enables the Bank and the Group to generate and deliver value to all its stakeholders and derive value in turn. Thus strategic goals, certifying the sustainability of operations of the Bank and the Group, are duly fulfilled. This process equally forges durable relationships with customers, offers mutually rewarding careers to employees, generates steady returns for investors, establishes profitable partnerships with partners while dealing responsibly with the society and the environment.

The Management Discussion and Analysis that follows describes in detail the initiatives that were undertaken during the period under review. They are organised as internal and external capital, within the context of the operating environment and the strategic direction detailed above.