External capital alludes to the value underpinning the diverse stakeholders of the Bank and Group. This is defined by resilient relationships and profitable partnerships sustained over the years through activities, interactions and linkages. Unlike the financial and institutional capitals, external capital is derived directly from our stakeholders: to include investors, customers, employees, business partners, society and the environment. We synergise our access and utilisation of external capital together with internal capital in powering our business to deliver value to and derive value from our stakeholders. Likewise, any enhancements we will be able to foster in our external capital will guarantee a harmonious increase in the value we derive in years to come.

Both institutional and individual persons, providing either equity or debt capital, make up the Bank’s investors. Consequently, they expect superior returns over short, medium and long-term periods. In turn, the Bank generates future earnings, whilst operating under the umbrella of secure risk management policies and control frameworks.

The Bank had 8,776 shareholders on 31 December 2016 (corresponding to a figure of 8,640 as at 31 December 2015), with the total number of shares in issue remaining fixed at 265,097,688 ordinary shares. Institutions account for approximately 86% of the Bank’s share capital. 76% of the total number of shares are held by local shareholders, both institutional and individual. Similarly, local shareholders account for 98% of all shareholders.

All shareholders of the Bank have equitable say on matters on the basis of one vote per ordinary share.

The Bank has not issued any non-voting ordinary shares nor preference shares.

Dividends and share price appreciation are the primary benefits afforded to shareholders. The Bank aims to regularly provide high total shareholder returns through profitable and sustainable performance. Dividends are determined based on growth in profits while taking in to account future cash needs and the maintenance of prudent ratios. The Board of Directors has approved a first and final dividend of LKR 4.50 per share for the year under review (period ended 31 December 2015: LKR 2.50).

The DFCC Bank share closed at LKR 122.50 on 30 December 2016. For the period, the highest share value of LKR 170.00 was recorded on 03 May 2016, with the lowest share value of LKR 116.10, being recorded on 30 November 2016. The 12 month period recorded a loss in share price of LKR 46.40 (27.47%). The share price tracked the movement of the All Share Price Index (ASPI) closely during the period under review.

Additional details are featured under Investor Relations.

Customers are an organisation’s most important asset and delivering good customer service is essential for success.

At DFCC Bank, our customers are at the heart of our strategy and the focus of our vision and values. We strive to provide professional services to them, to ensure that they experience the best we have to offer.

For the first time, DFCC Bank conducted a ‘Customer Service Week’ programme during the year, with the objective of driving the importance of customer service internally and creating a positive customer experience. The endeavour commenced with an address from the CEO and with all branches and service units signing a Customer Service Pledge which stated that the value of customer service will be upheld at all times.

The week was filled with various activities to educate staff on the importance of customer service as well as to appreciate both internal and external customers. A Customer Service Forum was also organised to conclude the week’s activities featuring two prominent guest speakers.

In order to enable long-standing customer relationships, the Bank focused more on delivering value beyond customer expectations, during the year under review. DFCC Bank’s value proposition was based on innovation, agility, technology and superior service standards. In line with these, the Bank implemented the following initiatives:

In the year 2017, the Payments and Cash Management Unit, a new department set-up at the Bank, will implement a cutting-edge cash management platform which will facilitate the redirection of customer payments and collections to and through the Bank.

This system will provide a virtual integrated payment and receivables system with automatic collection reconciliation that will help to manage customers’ liquidity, by having access to their net cash position at any given time. This proposition will be an integrated solution for a diversified range of customers. Through the implementation of such initiatives, DFCC Bank will strengthen its position as a leading provider of personalised cash management solutions in the industry.

Despite lacklustre private sector credit growth on account of rising interest rates and challenging economic conditions, Corporate Banking increased its credit portfolio by 14%, bearing testimony to DFCC Bank’s resilience amidst volatile market conditions.

The non-performing loan ratio of Corporate Banking, remained at 0.1% of the credit portfolio as at 31 December 2016. This is an impressive achievement for the unit in light of the difficult economic conditions and rising interest rates that prevailed throughout the year, and was as a result of the excellent credit evaluation practices adopted by the unit.

As a key lending unit, Corporate Banking continued to build on its strengths and to explore new avenues of growth during 2016 both locally as well as through off-shore lending.

The Bank reinforced its status as Sri Lanka’s pre-eminent financier of renewable energy projects by financing new Solar and Hydro projects. A noteworthy milestone achieved during the year was the successful commissioning and grid connection of the nation’s first 10MW Solar power project in December 2016, the financing of which was structured and syndicated by the Corporate Banking unit’s multi-faceted project financing team. A further 10MW project for which financial closure was achieved during 2016 is slated to commence commercial operation in the first quarter of 2017.

The unit is actively pursuing business opportunities in emerging economies in Asia and Africa with a particular emphasis on projects promoted by Sri Lankan investors in Maldives, Bangladesh and Uganda. During the year, the first project loan was extended to Maldives in the form of a US Dollar term loan facility for a five-star tourist resort, with a room count of 150. The Bank is currently negotiating financing packages for several renewable energy projects in Uganda and Bangladesh as well, in line with its thrust towards building a sound off-shore credit portfolio.

The Corporate Banking business development strategy was based on developing new relationships while strengthening existing partnerships. In line with this, two dedicated Business Development Managers (BDMs) were deployed to procure new business and cross-sell the Bank’s products and services. The unit also worked closely with the Business Initiatives Board Sub-Committee during the year, to identify and pursue new business opportunities.

Corporate Banking continued to adopt a holistic approach to providing financial solutions by offering the entire spectrum to its customers. Financial solutions such as leasing, payments and cash management, personal loans, mobile payments etc. are offered under one roof in addition to long-term and short-term lending products.

The unit continued to maintain a positive dialogue with its esteemed clientele by organising several customer functions throughout the year. The close interaction not only fostered closer relationships with clients, it was also a key driver of brand and product awareness.

DFCC Bank has observed that an emerging sub-segment within the Small and Medium Enterprise (SME) segment, titled Small Business Enterprise (SBE) has significant potential.

SBEs refer to enterprises that are positioned between SMEs and informal micro-enterprises. SBE financing is referred to as the ‘missing middle’ since the financial requirements of SBEs are too detailed for most microfinance institutions (MFIs) and they are considered as being too risky or costly for traditional commercial banks.

In order to address the requirements of this segment a new Strategic Business Unit named the ‘MSME Unit’ was set-up, to further increase the Bank’s penetration into the SME sector. The unit provides a range of financial solutions under the brand name ‘Vardhana Sahaya’ including loans, overdrafts, leases and bank guarantees, and is a one-stop financial solution for small enterprises.

During the year, Branch Banking reported a growth in assets and liabilities in light of the synergies achieved through the amalgamation with DFCC Vardhana Bank. This made a significant contribution to the Bank’s bottom line growth. The unit exceeded the income budget of 2016 and the non-performing ratio showed sound management with the prudent follow up and recovery measures adopted in the year.

Project and SME financing remained the main focus of branch lending activities while there was an increased focus on retail assets.

The portfolio of advances of DFCC Bank increased to LKR 108,364 million during the year recording a growth of 20%. The boost in project lending was mainly attributed to credit lines and the proactive engagement in drawing down from the multiple lines of credit available for SME lending.

In spite of industry competition and challenges, Branch Banking contributed positively to the overall liability base of the Bank. The CASA ratio grew to 20.88% and time deposits grew by 45%.

Particular attention was devoted to the concessionary loan scheme advertised through SMILE III (RF) and the European Investment Bank (EIB). The total funds disbursed by the branches under these lines of credit amounted to LKR 2,178 million. The key sectors supported were agriculture food processing, health services, industrial services, manufacturing and tourism. Several other lines of credit, including the Commercial Scale Dairy Development Loan Scheme (CSDLS), Saubhagya and the Small and Medium sized Enterprise Line of Credit (SMELoC) were implemented to finance loans to the SME sector.

Unique projects are redirected to the Specialised Lending Unit of the Bank situated at its Head Office. The unit undertook six projects worth LKR 2,162 million in 2016.

Another noteworthy mention is DFCC Bank’s commitment to the development of SMEs outside the Western Province of Sri Lanka. A substantial portion of these concessionary loan schemes were redirected to finance projects in outstation locations. Particularly, focus was given to projects in emerging provinces of the country to include the Northern, Eastern, Uva and North-Central Provinces.

Concurrently, DFCC Bank focused on the growth of the retail assets portfolio with particular attention given to personal loans, housing loans and leasing. Housing loans and personal loans reported a growth of 35% and 7.1% respectively.

The leasing market faced a number of challenges during the year, due to the Government mandating a loan-to-value (LTV) ratio of 70% and increasing the import duty leading to increased market prices of automobiles. Nevertheless, the unit was successful in growing the leasing portfolio by 3.1% in spite of these challenges.

The loan scheme Vardhana Sahanaya was launched to offer relief to individuals affected by the floods and landslides that occurred in mid 2016. This initiative was also expanded to the public affected by the fires in Salawa, Kosgama in June 2016. The loan scheme enabled individuals and businesses to rebuild homes and facilities with loans provided at concessionary interest rates.

The non-performing advances ratio of the branches declined to 3.07% from 3.91% during the period under consideration. This noteworthy accomplishment was due to the close monitoring of facilities reviewed on a daily basis by the branch, and on a monthly basis by the Regional Office and Head Office Teams.

The network of branches was further strengthened with the addition of two new centres and eight extension offices being revamped into fully-fledged branches.

Further, the number of regions were increased from six to seven, with the objective of securing greater control over the expanding branch network and regionalising the processing of credit facilities. In line with further improving the quality of credit evaluation and the speed of the approval process, the operations underwent a restructuring. Thus, experienced credit officers, under the guidance of regional managers were tasked with the challenge of processing larger facilities based on the grade of the branch.

The Branch Banking Unit is in the process of implementing several new initiatives in the 2017 business plan, to optimise the operational efficiency of the branch network and drive forward business growth. These include:

DFCC Bank’s Business Banking caters to the upper SMEs, lower corporate clientele and retail clients, and offers the entire range of banking services. These include; project loans, term loans, working capital facilities, trade facilities, overdraft facilities, debenture issues, fee-based products such as Letters of Credit and guarantees, as well as personal financial services including credit cards, leasing facilities, personal loans and housing loans.

A noteworthy achievement during the year was that DFCC Bank was recognised at the Karlsruhe Sustainable Finance Awards, winning a Certificate of Merit in the Outstanding Sustainable Project category, for funding a 4 MW Bio-mass project using Gliricidia Trees. This project was funded and structured by the Business Banking Unit’s lending team.

During the period under review, the Business Banking term deposit base, consisting primarily of fixed deposits grew by LKR 1,434 million. The aggregate liability base stood at LKR 16,288 million as at 31 December 2016. Despite the high interest rates that prevailed in the market, Business Banking grew the total loans and advances portfolio by LKR 2,234 million and the aggregate asset base stood at LKR 20,472 million as at 31 December 2016.

The Business Banking Unit will continue to focus on growing the deposit and CASA base in 2017 by promoting and cross-selling products and services to new and existing clients.

The aforementioned amalgamation of entities resulted in DFCC Bank positioning itself as a fully-fledged commercial bank in Sri Lanka. 2016 was thus a noteworthy year for the retail assets portfolio. Much attention and commitment was dedicated towards growing the retail portfolio of the Bank, which was LKR 29,618 million as at the year-end, demonstrating a growth of 12.3%

The retail assets team introduced product and process innovations in the bundle of products offered comprising personal loans, housing loans, leases and gold-pledged loans. The product innovations launched were the Vardhana Salary Booster and Vardhana Hiflex (a pre-approved loan facility). Further, Vardhana Personal Loans were restructured to offer greater benefits to customers. The process innovations implemented were the introduction of incentive schemes to reward sales staff and putting in place internal service level agreements in an effort to provide a rapid and efficient service to borrowers.

The expansion in the network of branches with improved access to newer locations enabled DFCC Bank to widen its scope of retail products. Engaging marketing campaigns via above-the-line and below-the-line mediums as well as social media, further improved product awareness across all segments nationwide. DFCC Bank employs a pool of competent ‘foot soldiers’ dedicated to serving customers at all times to meet their financial requirements.

The year under review was a noteworthy year for personal loans. Several new products were introduced to cater to the diversified requirements of borrowers. Personal loans are mainly for fixed-income earners of private and public organisations, but are also offered to self-employed borrowers.

DFCC Bank was proud to introduce Vardhana Salary Booster and Vardhana Hiflex, which includes an array of value-added benefits. Vardhana Salary Booster is a pre-approved overdraft facility covering up to 90% of the borrower’s monthly earnings, catering to executives with fixed incomes. Vardhana Hiflex is a tailor-made service catering to high net-worth fixed-income individuals. This also acts as a pre-approved overdraft facility encompassing up to 90% of a borrower’s monthly earnings. In addition, it can be combined with a personal loan of up to LKR 10 million as determined on the borrower’s credit repayment potential.

Several collaborations were undertaken to provide loan facilities for the installation of solar panels, in line with the Bank’s continuous commitment to investing in sustainable solutions. These initiatives were a success and will be continued in the future as well. Other mutual collaborations included tie-ups with educational institutions in providing funding for higher education.

Added emphasis was placed on the promotion of all retail asset products in the Northern and the Eastern Provinces of the country, as part of the North East reconciliation initiative. The strategy produced exceptional results, with the Eastern Province disbursing the highest percentage of personal loans.

A strong platform for growth in personal loans is further expected in the year to come, due to investments made in strengthening the Bank’s physical and product infrastructure. Another key strategy in growing the portfolio will be the presentation of bundled products, with the opportunity of cross-selling products to fixed-income earners.

DFCC Bank provides the Sandella Housing Loan with a promise to make a borrower’s dream home a firm reality. This tailor-made product caters to the entire range of funding requirements for home ownership which includes the purchase/construction of a house, the purchase of land, investments or condominiums. It further encompasses renovations and extensions to existing properties, as well as miscellaneous additions such as solar panel installations.

The loans are intended for a wide cross-section of demographic, ranging from business and professional executives, to public and private-sector employees, self-employed individuals as well as Sri Lankan citizens in foreign employment. These loans are priced at attractive rates and the tenure can be structured to suit the repayment capacity of the borrower.

During the year, the housing loan portfolio recorded a growth of 35%, with most of the contribution coming from the outstation branches, accounting for 58% of the total portfolio.

The surge in the development of residential skyscrapers has made it possible to target the high net-worth segment for housing loans. Throughout 2016, the Bank was instrumental in negotiating contracts with the developers of apartments to mutually collaborate for business generation.

These activities contributed significantly to the loan portfolio whilst simultaneously enhancing the brand image of the Bank.

The expanding branch network has contributed significantly to the wide spread reach of our services. The focus of DFCC Bank in the coming year will be to enhance product value and pursue the financing of vertical living.

DFCC Bank has been recognised for its contribution to the development of the nation’s economy and wider society by esteemed local and international organisations. Among its proficiencies in all spheres of the banking industry, the Bank has been the pioneer in providing leasing solutions since 1984.

The leasing industry experienced several setbacks during the year, mainly due to contracting economic and regulatory conditions. The Government mandated loan to value (LTV) ratio for financing of automobiles and hikes in vehicle duties curtailed credit growth. Furthermore, the rise in lending rates throughout the year confined credit growth to a minimum level throughout the year.

In spite of these preconditions, DFCC Bank recorded a net growth rate of 3% in the leasing portfolio. Outstation branches contributed significantly to this figure. A market growth was seen in the Northern and the Eastern regions of the country as contrasted with the preceding year. 2016 represented a landmark point in the Bank’s leasing business and the Bank expects similar momentum and success in 2017.

The Bank maintained its market presence through the implementation of successful promotional campaigns nationwide, partnering with reputed vehicle suppliers. Further, successful regional promotional campaigns were also held in collaboration with regional motor vehicle suppliers. Through the combined efforts of these, the Bank has been able to communicate with a substantial customer base spread across differing sectors thus compiling a well-diversified geographic portfolio.

Existing processes, including incentive schemes for sales staff and flexible approval mechanisms, underwent several changes throughout the year. These were further consolidated by upgrading to the loan origination system which was introduced towards the early part of the year.

Gold-pledged lending or pawning is a popular loan product amongst the rural communities in Sri Lanka, due to the ease of obtaining funds. In 2016, there was a significant growth in the pawning portfolio in comparison to the preceding years, and the Bank is hopeful that the growth momentum will continue in the forthcoming year.

Marketing campaigns were primarily targeted at the North Eastern region of the country to create brand awareness.

At the same time, a below-the-line promotional campaign played a significant role in reversing negative growth. DFCC Bank is looking forward to an optimistic performance in 2017.

The Bank obtained Principal Membership status of Visa International and is in the process of obtaining direct connectivity for both credit and debit cards. A new card management system is also being developed.

The Bank launched the Visa International debit card in 2011 which provides unparalleled access to over 37 million accredited merchants worldwide for the purchase of goods and services. It can be used for withdrawing cash through a global network of over three million ATM’s.

During the year, the Bank reported a total of over 112,000 debit cards with 28,000 new cards being issued. Debit card usage stood at, LKR 3,100 million representing 335,000 ATM transactions and LKR 480 million from 185,000 POS terminal transactions.

In addition to its standard Visa debit cards, DFCC Bank has introduced three unique cards for premier banking customers titled; Premier Plus, Premier and Prabhu.

EMV Chip technology is to be introduced to debit cards in 2017 following the completion of the direct Visa connectivity project. This new technology will reinforce the security of debit card transactions.

DFCC Bank’s credit card range covers the internationally valid Visa Classic, Gold and Premium cards, with the Platinum cards issued to key customers of the Bank, having numerous additional features. Corporate cards are targeted at the Bank’s corporate customers. The introduction of Visa Signature credit cards, mainly aimed at high net-worth individuals, is being considered for 2017.

All issued credit cards are chip-reinforced and provide stringent protection against credit card fraud. This includes SMS alert messages pertaining to transactions and a 24-hour support hotline.

The aggregate credit exposure of the credit card portfolio stood at LKR 806 million as at 31 December 2016, representing a card usage of LKR 485 million. The operation of credit cards remains a viable business line for DFCC Bank despite the Bank’s late entry into the market. The card portfolio is free of material mismatches due to the prudent screening methods employed by the Bank in the issuing of credit cards.

DFCC Bank also offers the Multi Currency Global Travel card in its portfolio of products. This is a prepaid card which offers the option of pre-loading and accessing four international currencies in one card, at any given time, thus significantly helping the customer to reduce additional costs arising from multiple currency conversions.

The Bank provided credit card acceptance technology to merchants with the assistance of a local processor starting from the third quarter of 2015. As at the end of 2016, over 200 merchant establishments have been equipped with card acceptance technology.

The Treasury Front Office (TFO) of DFCC Bank consists of three main income generating units. They are, the Foreign Exchange and Money Markets Unit, the Fixed Income Unit and the Treasury Sales Unit that report directly to the Head of Treasury. The Head of Treasury similarly oversees operations of the Resource Mobilisation Unit which handles all long-term funding through credit lines, syndicated loans, local and international debt issuance, related rating activities, strategic and non-strategic investments and divestments in equity and unit trust investments. The equity portfolio was consolidated under the Treasury and Resource Mobilisation Unit during the considered time frame, in line with the synergies of the respective operations, and with the objective of future business growth.

The operations of the Treasury Middle Office (TMO) were enhanced in line with the regulatory guidelines. This office functions autonomously and reports to the Chief Risk Officer.

The Treasury Back Office (TBO) is accountable for the preparation, verification and authorisation of the payments of all transactions made by the TFO. In order to operate independently, and as moderated by regulatory guidelines, the Treasury Back Office reports to the Head of Finance.

For the period under consideration, the Central Bank of Sri Lanka (CBSL) imposed a stringent monetary policy stance in light of the rising credit demands emanating mainly from the private sector. These measures were intended to tame demand-driven inflation and support the nation’s Balance of Payments.

The CBSL raised the policy rates twice in the past year leaving policy rates Standard Deposit Facility (SDF) and Standard Lending Facility (SLF) at 7.00% and 8.50% respectively as at the end of December 2016, compared with rates of 6.00% and 7.50% at the beginning of the year.

In December 2015, the CBSL decided to increase the Statutory Reserve Ratio (SRR) applicable to all Rupee deposit liabilities of commercial banks by 1.50% to 7.50%, effective from the reserve week commencing 16 January 2016.

The credit growth in the private sector recorded a high of 28.5% in July, up from 25.7% at the beginning of the year. Nevertheless, these levels started to decline due to an upward adjustment in the interest rates with the tightening of monetary policy rates.

The economy faced numerous challenges during the year from both internal and external fronts. Government borrowings recorded a rise due to debt repayments and increasing public expenditure as the new administration continued its work.

Sri Lanka’s sovereign credit rating was relegated from ‘BB-’ to ‘B+’ and assigned a negative outlook by Fitch Ratings. Standard and Poor’s rating agency assigned a ‘negative’ outlook from a previous ‘stable’ view on the country’s sovereign credit rating, referencing rising fiscal and external imbalances. The FED also raised their target rate in December by 0.25% each, leaving the rate at a range of 0.50% to 0.75%.

As a result of these events, Sri Lanka witnessed a huge outflow of foreign investments in both debt and equity markets, placing additional pressure on the Rupee. Nevertheless, the Extended Fund Facility (EFF) of USD 1,500 million assigned by the IMF to support the country’s economic reform agenda built confidence in the minds of both foreign and local investors. This was further complemented by the raising of USD 500 million through a five year sovereign bond and USD 1,000 million through a 10 year sovereign bond in the international markets.

The interbank money market rates continued to rise during the year, due to continued Government borrowings as well as credit growth in the private sector. The overnight money market rates and repurchase rates closed the year at 8.40% and 8.50% respectively, compared with rates of 6.40% and 6.50% at the start of the year.

Market liquidity levels remained volatile, closing the year with a surplus of LKR 39,220 million. The benchmark Government Treasury Bill and Bond yields also increased incrementally during the period, taking a cue from the increase in policy rates. Treasury Bill rates rose to 10.17% from 7.30%, five year bonds increased to 11.90% from 9.60% and 10 year bonds expanded to 12.50%.

The Treasury Fixed Income (FI) desk made significant gains through trading activities and interest income under this less than favourable environment. The FI portfolio rested at LKR 46,604 million whilst the encumbered portfolio (reserved for REPO transactions) stood at LKR 16,310 million at the end of the year.

The local foreign exchange markets continued to be under strain having noted a full year depreciation of 4.23% mainly due to outflows in foreign investment as a consequence of expected increase of FED rates, debt repayments, and pressing importer demand, contrasted with the growth in the export sector. The exchange rate as at the end of December 2016 stood at LKR 150.00 compared to LKR 143.90 as at the end of December 2015.

The USD/LKR forward premiums increased during the latter part of the year, recording one month premiums at LKR 1.05, three month premiums at LKR 2.80, six month premiums at LKR 5.20 and 12 month premiums at LKR 10.20. In spite of this formidable environment, the DFCC Bank Treasury recorded LKR 176.35 million through FX trading activities while contributing to reducing the cost of funds through its FX swap operation.

During the year, the Treasury introduced Money Market based Rupee and US Dollar savings accounts namely Vardhana Xtreme Saver and Vardhana Xtreme Dollar Saver in order to support the CASA base of the Bank. These two products made significant contributions during the latter part of the year to achieve the desired CASA ratios.

The Treasury also catered to the increasing demand for floating rate fixed term FCY deposit products by introducing the Sri Lanka Development Bond (SLDB) linked deposits that helped the Bank in attracting new funds to grow the balance sheet.

Moving forward, with customer service at its core, treasury will engage in a series of process improvements with the support of the IT Department. The main focus will be on upgrading existing systems to improve the handling of growing volumes whilst improving the efficiency in the pricing of fund transfers.

As at 31 December 2016, the combined cost of investments in DFCC Bank’s holdings of quoted shares [excluding the investment in the voting shares of Commercial Bank of Ceylon (CBC) PLC], unquoted shares and unit holdings amounted to LKR 1, 648 million.

The composition of the investment portfolio is detailed as follows:

| Cost LKR million | Market Value LKR million | ||

|

Quoted share portfolio (excluding CBC voting) |

693 | 999 | |

| Unit Trust portfolio | 843 | 996 | |

| Unquoted share portfolio | 112 | 112 | |

| Total | 1,648 | 2,107 |

The cost of the unquoted share portfolio is carried at cost on the balance sheet. The market value of the holding in the voting shares in CBC was at LKR 17,798 million as at the end of December 2016, against a cost of LKR 3,508 million.

During the period under review, DFCC Bank made particular divestitures in mature quoted shares and unquoted shares. By implementing this, the Bank was able to realise notable returns amounting to LKR 152.18 million as capital gains. During this time frame, DFCC Bank also made new strategic investments in quoted shares at LKR 37.3 million.

DFCC Bank was appointed by the Government of Sri Lanka to implement the EIB SME & Green Energy Global Loan credit line in March 2014. 70% of the credit line was allocated for SME projects and the balance 30% for renewable energy and energy efficiency projects. Attractive features of the credit line were the long repayment period offered at a low fixed interest rate and the relatively large loan amount.

The entire loan of €90 million was allocated within the stipulated period. Net of cancellations, this amounted to approximately LKR 14,662 million for 171 projects from three participating intermediary banks including DFCC Bank. Of the amount allocated, by the year-end, LKR 12,406 million had been disbursed as refinance to intermediary banks for the benefit of their customers.

SME projects in a variety of sectors island-wide were approved for funding. Prominent sectors were auto services & repair, bakery products, construction, education, healthcare, manufacturing including agro-processing, printing, retailing, tourism, and trading. Under ‘Green Energy’, notable achievements during the year were a 10MW Solar power plant and a 4MW sustainable Bio-mass based combined heat and power co-generation plant commencing the supply of power to the national grid.

In 2016, trade services recorded total fees and commissions of LKR 381.6 million. The business volume handled by trade services consisting of Letters of Credit and received import bills stood at LKR 55,572 million.

Despite the setbacks, the macroeconomic environment of the country was not conducive for the import and export sectors during the year. The introduction of Loan to Value (LTV) ratios and increase in import tax of vehicles contributed to a decline in vehicle imports. According to CBSL statistics, the import of vehicles was reduced by 53.7% as at 31 August 2016.

The tea industry faced similar challenges, primarily due to droughts, and volatile situations in the Middle East.

However, the Bank continued to increase its trade client base comprising corporates as well as SMEs through corporate banking, business banking and branches. The correspondent banking network was further expanded to ensure that clients are able to do their transactions hassle-free, through the respective banks of buyers and sellers. The unit has continued to improve service standards attributable to its efficient and dedicated team and implementation of improved technology.

In order to reinforce its commitment towards the trade and business community, DFCC Bank sponsored the World Export Development Forum (WEDF) as the Exclusive Banking Partner, which was conducted in Sri Lanka in October 2016. Further information on this event is given under Social and Environmental Capital section.

During this period, DFCC Bank introduced a unique package for exporters with the intention of attracting new clients through the WEDF platform.

The period under consideration was a productive one for remittances as DFCC Bank comfortably exceeded the 30% budgeted increase in income. This was mainly as a result of increasing outward remittances and inward telegraphic transfers processed during the year. The income from Western Union, drafts, issuance of currency notes and purchases remained static during the year.

The branches, together with the Business Development Department were key players in growing the business volumes during 2016. The remittances team was also able to build customer relationships by offering exceptional customer service. The team was successful in detecting a significant number of payment requests that were the target of cyber attacks and thus helped to eliminate the loss of valuable foreign exchange to the customer and the country.

Throughout the year, internal service agreements were fine-tuned to develop the customer portfolio. The team is confident in its ability to grow remittance income lines in the future, thus contributing significantly to the Bank’s bottom line.

The Bank has demonstrated a strong performance in Bancassurance, within a short time frame, since its official launch in 2014.

During the year, the life insurance operation at DFCC Bank was further enhanced with the signing of a long-term agreement with AIA Insurance Lanka PLC. This strategy has paved the way for a dynamic product and service offering to the Bank’s clientèle.

Initiatives in raising customer awareness on the mitigation of risks associated with business and life were also implemented through events and programmes conducted by AIA and DFCC Bank at branch level. Customers were able to seek personalised consultation on financial planning, retirement planning, planning for their children’s higher education etc. Similarly, loan and lease customers benefited from insurance advisory, and rate and claim settlements through the centralised general insurance operation which comes under the purview of the Bancassurance unit.

Bancassurance has contributed significantly to the Bank’s bottom line as a key Other Income source, denoting high future potential.

The main objective of the Bancassurance business is to offer products at an international quality standard. This unit thus works diligently towards protecting its customer base from all possible risks associated with business and life.

The year under consideration was one of consolidation and unification, following the amalgamation with DFCC Vardhana Bank in 2015. Although DFCC Vardhana Bank was an integrated subsidiary of DFCC Bank, with many operations being executed centrally, certain cultural differences existed between the two entities mainly due to the differing staff profiles required by the respective pre-amalgamation business models.

Consequently, 2016 saw greater focus being given to strengthening a sustainably integrated culture developed on a foundation of shared values, aspirations and philosophies.

DFCC Bank implemented the Great Place to Work initiative in July 2016, aimed at building a transformational working culture. The assignment was conducted in several phases and encompassed; aligning the Bank’s values to business strategy, interpreting individual behaviours demonstrating these values, carrying out a culture audit to identify strengths and possible changes required to key practices to ensure alignment to support behavioural change, engaging all employees through large group interventions to create positive energy and building ownership of values and associated behaviours. In addition, customised people management workshops were conducted for all levels of management, aimed at improving consistency in people management capability and providing managers with the necessary tools to foster an encouraging environment for their staff, inspiring them to ‘live the values’.

Following the successful conclusion of the assignment, 50 plus initiatives are being further implemented to enhance the People practices of the Bank.

Other initiatives that were introduced to facilitate integration included, reviewing operational and business structures and taking steps towards fulfilling necessary alignments towards optimising efficiency and delivery.

DFCC Bank remained aware of the strategic imperative in ensuring employee productivity, in harmony with rapid growth and diversification of its businesses. Capacity planning and staff rationalisation methodologies initiated in 2015 continued in 2016 as well. With focused intervention, the ratio of business facing staff to support staff showed continued improvement over the last two years.

Many operations in branches were centralised, resulting in a sizable pool of staff being available for re-skilling and redeployment in business roles. Targeted re-skilling programmes were initiated for identified staff who were provided with the necessary training and mentors to guide them through the transition. The HR Department closely monitored their progress through regular performance updates from their supervisors and one-on-one interactions.

DFCC Bank holds firm to its belief that diverse and unencumbered channels of communication are decisive factors in its journey towards a progressive and integrated working environment.

The Bank has many systems in place to keep its employees informed of internal events and external developments that may impact them. In addition, it possesses multiple platforms that enable employees to voice their opinions, concerns and suggestions. DFCC Bank practices an open-door policy whereby all employees have direct and easy access to senior management and the CEO. The Bank’s newsletter, The Weekly Round Up shares frequent updates on internal developments. Regular meetings are organised with the participation of different staff groups, to enlighten employees on strategic considerations and new developments. These meetings also serve as forums, enabling employees to interact with senior management and express their views or concerns. Video communication is used from time to time to disseminate information to the regionally dispersed workforce. The e-Learning platform and HR portal also provides employees with access to information on HR practices and policies that may impact them. A comprehensive staff handbook can also be accessed online, enabling employees to learn and refresh themselves on workplace practices, regulations, benefits, conduct etc.

The Bank also inaugurated an HR Business Partner initiative, whereby an HR officer was assigned to the larger business and service units. The Business Partner interacts with supervisors and staff to aid them in expediting and resolving issues relating to business strategy or operations. The HR officers visit the branch network on a planned roster throughout the year to meet staff on a one-on-one basis to identify and address any concerns they may have.

In keeping with its value of being innovative, the Bank proactively encourages bottom-up feedback on process improvements, cost management and business enhancement measures. During 2016, employees were encouraged to express ideas and suggestions at ‘Open Days’ held with the presence of the Chairman, CEO and Deputy CEO. The younger millennial employees were given a platform to gain visibility and showcase their ideas on topics of relevance for future growth and strategic initiatives of the Bank, to members of the Board and Senior Management.

The latter part of the year saw the DFCC Innovators; a team of cross-functional volunteers, being set-up with a mandate to encourage the surfacing of novel ideas and innovations through multiple channels and ensure that promising ideas are selected, honed, and further developed for the benefit of all.

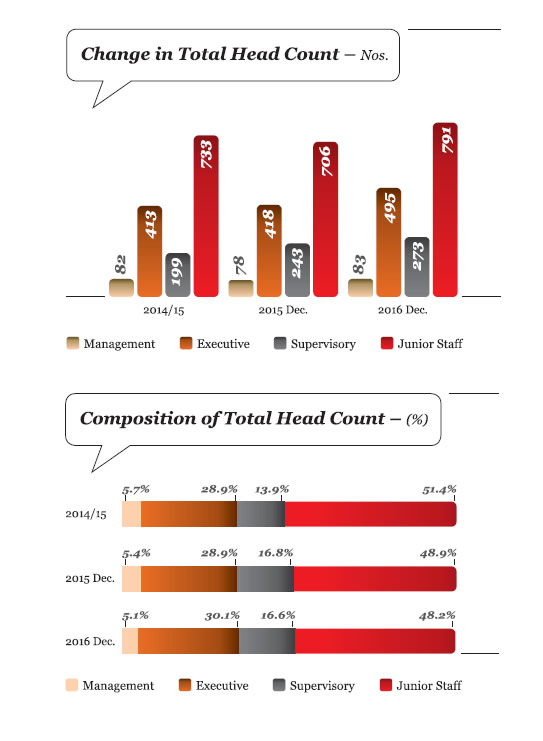

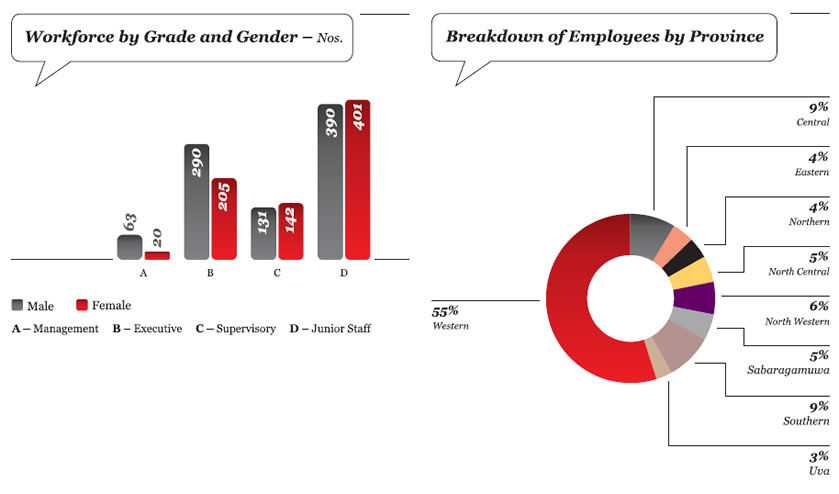

DFCC Bank reported an aggregate head count of 1,642 employees as at the end of December 2016. This is an increase of 13.8% from the corresponding figure in 2015. The employee distribution ratio, with regard to gender, stood at respectable levels; at a ratio of 53% male to 47% female.

As in previous years, the Western Province accounted for the largest number of employees. For the period under review, 55% of employees were stationed in the Western Province with the Southern and the Central Provinces, accounting for the next highest dispersion at 9% each. The Northern and the Eastern Provinces, with 16 branches, accounted for 8% of the total workforce.

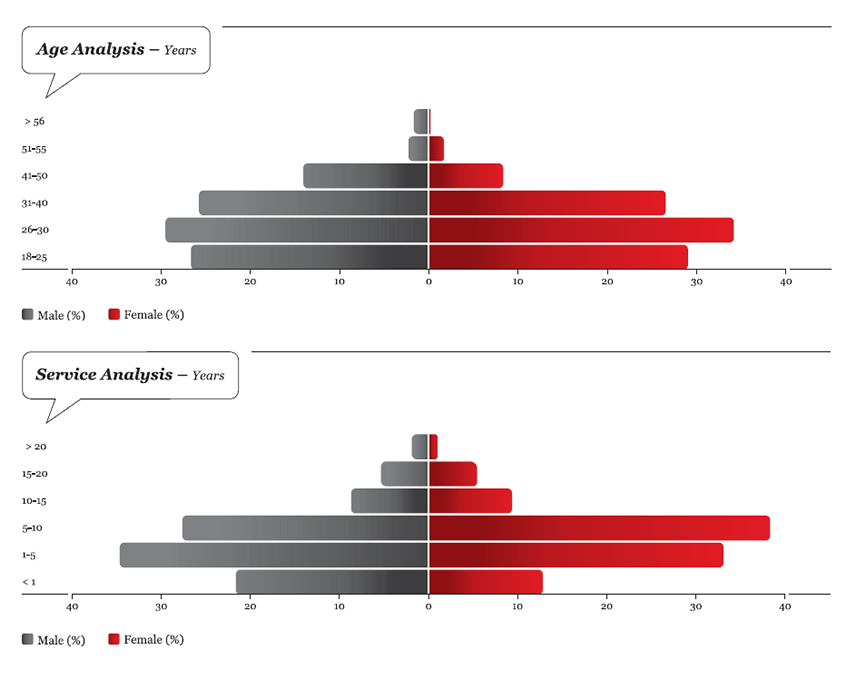

The following graphs offer a detailed and numerical representation of several other relevant aspects of staff demographics:

Permanent Employees by Employment Type and Gender

| December 2016 | December 2015 | 2014/15 | ||||||||||

| Grade | Male | Female | Total | Male | Female | Total | Male | Female | Total | |||

| Management | 51 | 19 | 70 | 51 | 15 | 66 | 53 | 17 | 70 | |||

| Executive Staff | 255 | 186 | 441 | 210 | 171 | 381 | 203 | 165 | 368 | |||

| Supervisory Staff | 130 | 142 | 272 | 123 | 117 | 240 | 106 | 92 | 198 | |||

| Junior Staff | 243 | 299 | 542 | 249 | 332 | 581 | 271 | 369 | 640 | |||

| Total | 679 | 646 | 1,325 | 633 | 635 | 1,268 | 609 | 626 | 1,235 | |||

Workforce by Employment Type/Contract and Gender

| Permanent | Contract/Casual/Part time | Total Number of Employees | ||||||||

| Grade | Male | Female | Total | Male | Female | Total | Male | Female | Total | |

| Management | 51 | 19 | 70 | 12 | 1 | 13 | 63 | 20 | 83 | |

| Executive | 255 | 186 | 441 | 35 | 19 | 54 | 290 | 205 | 495 | |

| Supervisory Staff | 130 | 142 | 272 | 1 | 0 | 1 | 131 | 142 | 273 | |

| Junior Staff | 243 | 299 | 542 | 147 | 102 | 249 | 390 | 401 | 791 | |

| Total | 679 | 646 | 1,325 | 195 | 122 | 317 | 874 | 768 | 1,642 | |

Workforce by Employment Contract and Gender

| Number of Employees | Composition of Employees (%) | |||||||

| Employee Type | Dec. 2016 | Dec. 2015 | 2014/15 | Dec. 2016 | Dec. 2015 | 2014/15 | ||

| Full-time - Male | 874 | 726 | 707 | 53 | 50 | 50 | ||

| Full-time - Female | 768 | 719 | 720 | 47 | 50 | 50 | ||

| Total | ||||||||

| Outsourced - Male | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Outsourced - Female | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Total | 1,642 | 1,445 | 1,427 | 100 | 100 | 100 | ||

Workforce by Grade and Age

| Management | Executives | Supervisory Staff | Junior Staff | |||||

| Age Group | Count | % | Count | % | Count | % | Count | % |

| 18-25 | 0 | 0 | 18 | 4 | 1 | 0 | 437 | 55 |

| 26-30 | 0 | 0 | 144 | 29 | 95 | 35 | 282 | 36 |

| 31-40 | 6 | 7 | 245 | 49 | 130 | 48 | 48 | 6 |

| 41-50 | 52 | 63 | 77 | 16 | 42 | 16 | 16 | 2 |

| 51-55 | 16 | 19 | 7 | 1 | 4 | 1 | 6 | 1 |

| 56 + | 9 | 11 | 4 | 1 | 1 | 0 | 2 | 0 |

| Total | 83 | 100 | 495 | 100 | 273 | 100 | 791 | 100 |

Workforce by Region and Gender

| December 2016 | December 2015 | 2014/15 | ||||||||||||||||||

| No. of Employees | No. of Employees | No. of Employees | ||||||||||||||||||

| Province/Departments and Other Business Units | No. of Branches | No. of SLP Units | Male | Female | Total | No. of Branches | No. of SLP Units | Male | Female | Total | No. of Branches | No. of SLP Units | Male | Female | Total | |||||

| Central | 11 | 4 | 95 | 45 | 140 | 10 | 4 | 69 | 47 | 116 | 10 | 4 | 62 | 47 | 109 | |||||

| Eastern | 8 | 2 | 52 | 21 | 73 | 7 | 4 | 50 | 22 | 72 | 7 | 4 | 48 | 22 | 70 | |||||

| Northern | 6 | 0 | 38 | 23 | 61 | 6 | 0 | 34 | 21 | 55 | 6 | 0 | 36 | 22 | 58 | |||||

| North-Central | 6 | 3 | 50 | 25 | 75 | 3 | 6 | 42 | 20 | 62 | 3 | 6 | 39 | 23 | 62 | |||||

| North-Western | 7 | 3 | 51 | 46 | 97 | 6 | 4 | 36 | 38 | 74 | 6 | 4 | 34 | 40 | 74 | |||||

| Sabaragamuwa | 7 | 8 | 43 | 40 | 83 | 5 | 10 | 36 | 35 | 71 | 5 | 10 | 32 | 36 | 68 | |||||

| Southern | 9 | 14 | 72 | 73 | 145 | 9 | 14 | 67 | 67 | 134 | 8 | 15 | 69 | 65 | 134 | |||||

| Uva | 4 | 5 | 38 | 19 | 57 | 4 | 5 | 38 | 18 | 56 | 4 | 5 | 41 | 20 | 61 | |||||

| Western | 32 | 8 | 185 | 188 | 373 | 29 | 11 | 146 | 176 | 322 | 29 | 11 | 144 | 175 | 319 | |||||

| Departments and Other Business Units | 69 | 0 | 250 | 288 | 538 | 63 | 0 | 208 | 275 | 483 | 74 | 0 | 202 | 270 | 472 | |||||

| Total | 874 | 768 | 1,642 | 79 | 58 | 726 | 719 | 1,445 | 78 | 59 | 707 | 720 | 1,427 | |||||||

Note: Number of staff attached to Regional offices are included with respective province staff count

Keeping in mind the long-term strategic implications of optimising productivity and managing costs, a capacity review was conducted across the branch network which accounts for the majority of the Bank’s workforce and several departments deploying larger staff numbers. Following the review, certain redeployments were done with selected employees being allocated to more value-adding roles.

At year-end, the employee head count reflected a significant increase from the preceding year, given that the head count was maintained at relatively stable levels for the past couple of years. The increase was necessitated primarily due to boosting of the dedicated sales cadre, new branch openings and adoption of new business offerings. Some recruitments to mid-level and senior-level positions were also done during the year to address critical talent gaps.

New employees were mainly sourced through referrals, print and social media advertising. To position the Bank’s brand as an employer of choice, a concerted effort was made to participate in career fairs, during which career guidance and tips on interview techniques were provided to prospective applicants.

The Management Trainee Programme was recommenced after three years.

The thousands of applications received for the programme were an encouraging endorsement of the DFCC brand. The large number of applicants were culled through a series of selection criteria culminating in welcoming on board ten management trainees. These trainees will be provided with classroom and on-the-job skilling, opportunities for cross-functional exposure through planned job rotations and participation in special assignments and projects to further broaden their exposure.

Further, to facilitate the integration of the new team members into the Bank and its culture, a ‘Buddy Programme’ was implemented. New recruits are assigned a ‘buddy’ who is tasked with ensuring they are welcomed, introduced to colleagues, provided with the required facilities, and advised on navigating internal systems and procedures.

For the year under consideration, 365 new employees joined the Bank, of which almost 83% were below 30 years of age. In line with the Bank’s commitment to growing talent from within, it was noteworthy that recruitment to management grades was less than 2%.

New Hires by Age Group and Gender

| Grade | New Employees Joining in the Current Financial Year | ||||||

| Age Group | Gender | ||||||

| Less Than 30 Years | Between 30-50 Years | Above 50 Years | Total | Male | Female | Total | |

| Management | 6 | 1 | 7 | 5 | 2 | 7 | |

| Executive | 59 | 33 | 2 | 94 | 67 | 27 | 94 |

| Non-Executive | 2 | 13 | 15 | 14 | 1 | 15 | |

| Other/SLP | 241 | 8 | 0 | 249 | 163 | 86 | 249 |

| Total | 302 | 60 | 3 | 365 | 249 | 116 | 365 |

During the year, 124 employees resigned from service out of which the majority was sales staff. This reflects previous trends, as this is a particular segment of the workforce that tends to show high volatility in terms of retention. The annual attrition rate, excluding sales staff amounted to 6.4%.

Of 719 eligible employees, 9.3% availed of parental leave, with 99% returning to work. Employees who continued to stay employed at the Bank after 12 months of returning to work following parental leave constituted a figure of 85%.

| Grade | Number of Employees Resigned* | ||||||

| Age Group | Gender | ||||||

| Less Than 30 Years | Between 30-50 Years | Above 50 Years | Total | Male | Female | Total | |

| Management | 0 | 2 | 3 | 5 | 4 | 1 | 5 |

| Executive | 14 | 24 | 0 | 38 | 19 | 19 | 38 |

| Supervisory Staff | 4 | 9 | 0 | 13 | 8 | 5 | 13 |

| Junior Staff | 65 | 3 | 0 | 68 | 44 | 24 | 68 |

| Total | 83 | 38 | 3 | 124 | 75 | 49 | 124 |

*Excluding terminations/retirements/contract expiries

Proactive career planning continued to be a priority in 2016 as well. In keeping with the Bank’s focus to adopt a collaborative and inclusive approach in employment practices, an internal cross-functional team was set-up and mandated with reviewing and recommending improvements to the performance management framework.

The team thus presented a revised framework synthesising feedback obtained from employees, which was adopted for the year under consideration.

The ‘Nine Box’ talent identification and differentiation process continued to be practiced, with all executive personnel being assessed annually, and consequently being provided with development opportunities and individualised attention, if so warranted. Two new talent management programmes; Ascendants! and Rise! were launched, focusing on career enhancement and performance improvement respectively.

Other initiatives, such as the supervisory level operations certification programme continued with the participation of 45 individuals of which 25 successfully completed the certification. The career advancement programme continued into its fourth consecutive year of operation, from its inauguration in 2012. The programme has enjoyed continued success and has enabled 34 employees since its inception to transition to executive roles.

The Bank’s promotion framework is structured around multiple factors such as the availability of job roles, individual competencies, experience and qualifications. As a component of the Bank’s post-amalgamation integration initiatives towards rectification of inequities, an interim promotion framework was adopted whereby alternate qualifications are accommodated for a period of two years, so that employees satisfying other criteria are able to successfully advance in their careers.

In addition, a customised assessment programme was developed in collaboration with the Institute of Bankers in Sri Lanka, to enable experienced staff who do not possess any qualifications to aspire for advancement opportunities. A total of 22 employees took part in the initiative and assessment, following which 16 were selected for placement at a higher grade.

Furthermore, during the year, 255 employees, representing 16.5% of the average workforce, were promoted to higher positions reiterating the Bank’s continued commitment towards enabling internal career advancement opportunities for staff.

Throughout the year, the Bank demonstrated dedication towards the advancement and growth of its employees with 7,110 participants attending 355 programmes. Out of these, 146 were organised in-house, primarily utilising internal resources. Cumulative training hours amounted to 60,035 demonstrating a marked increase of 34% over the preceding year.

Classroom training was supplemented by sources such as e-learning, job rotations and role enhancements aimed at developing a versatile and competent workforce. Of the classroom-based training, 69% was concentrated on technical and sales programmes. Ensuring value generation from training investments continued to be a priority with relevant programmes being pegged to ROI measures.

DFCC Bank’s e-learning platform continued to be a popular learning tool for its regionally-dispersed workforce. Over 17,600 learning hours were clocked in during the year. The platform was widely used to conduct assessments and product quizzes as well. A survey showed that 58% and 42% of respondents rated the service as ‘excellent’ and ‘very good’ respectively.

For the year under review, the cumulative average training hours per employee was 50.25. This represented an increase of 14.7% over the preceding year.

| Number of Person Hours of Training | Average Training Hours Per Employee | |||||

| Male | Female | Total | Male | Female | Total | |

| Management | 2,375 | 823 | 3,197 | 37.70 | 41.13 | 38.52 |

| Executives | 11,571 | 8,035 | 19,605 | 39.90 | 39.19 | 39.61 |

| Non Executives | 20,675 | 16,556 | 37,232 | 39.68 | 30.49 | 34.99 |

| Total | 34,621 | 25,414 | 60,035 | 39.61 | 33.09 | 36.56 |

* Excluding e-learning

January to December 2016

| Total Person Hours | |

| In-house | 55,002 |

| External | 4,633 |

| Foreign | 400 |

| Total | 60,035 |

As DFCC Bank secures its position as a fully-fledged commercial bank, the necessity of maintaining a strong sales-oriented mindset is critical towards its continued success and relevance in the industry. This was addressed through regular communications to staff emphasising on sales, redeployment of staff to front-line roles and on attracting and developing a competent and dedicated sales force.

During the year, sales recruitments amounted to 34% of total resourcing. While sourcing and retaining talent with the necessary competencies and interest in sales continued to be a challenge during the year, much attention was devoted towards attraction and retention of such talent by introducing a dedicated sales career path, more flexible promotion mechanisms, ensuring competitive incentive structures and revamping sales orientation and refresher training programmes. During the year, 13 in-house sales focused programmes were conducted benefiting 628 participants. Achievements were recognised and rewarded at the Annual Sales Awards Night held in June.

| Employment Type | Housing Loan | Vehicle Loan* | Educational Expenses* | Professional Subscription* | Social Club Gymnasium* | Miscellaneous Staff Loan | Festival Advance** | MBA Loan | Holiday Grant*** |

| Permanent | √ | √ | √ | √ | √ | √ | √ | √ | √ |

| Contract | x | x | x | x | x | x | x | x | x |

*Executive Trainees and Management Trainees on fixed term contracts are also provided this benefit

** Only for non-executive staff

***Based on the offer of employment this also may be provided to contract staff

Through the quarterly held Rewarding Excellence Scheme, the Bank acknowledged the achievements of 18 employees nominated by their supervisors and peers. The nominees were recognised and rewarded in the presence of members of the Board of Directors and Senior Management.

At the Annual Dinner Dance, branch, team and individual awards were presented in recognition of exceptional contribution and service delivery. Supplementary recognition awards in the fields of sales, bancassurance, retail assets and leasing were also distributed throughout the year.

In addition, the employee appreciation scheme was conducted successfully for the second consecutive year with supervisors utilising the allocated annual budgets provided to them to organise a variety of year-end activities for their teams.

DFCC Bank remains committed to integrating diversity, inclusion and equality into its ethos. As an equal opportunity employer, the Bank strives to ensure that the most suitable candidate is appointed for the job irrespective of age, gender, disability or cultural background.

DFCC Bank believes that its commitment to securing an integrated workforce is a direct precursor to its success and ensures innovative thinking, stronger collaborative performances and resilient partnerships well into the coming years.

Ratio of Salary of Men to Women by Employee Category

| Grade | Number of Employees |

Basic Salary

Ratio, Male/Female |

||

| Male | Female | Total | ||

| Management | 63 | 20 | 83 | 48:52 |

| Executive | 290 | 205 | 495 | 51:49 |

| Supervisory Staff | 131 | 142 | 273 | 51:49 |

| Junior Staff | 390 | 401 | 791 | 50:50 |

| Total | 874 | 768 | 1642 | 50:50 |

The Bank has a zero tolerance policy towards workplace harassment or marginalisation.

Employees are able to express dissatisfaction and grievances without constraint. A formal Board-endorsed Grievance Policy is in place and provides employees with detailed guidelines on the appropriate measures to be taken to address grievances and means of escalation.

A Secure Environment Policy sets out appropriate workplace conduct and the recourse available to employees experiencing harassment from colleagues

or superiors.

A Grievance Committee consisting of a team of mid and senior-level staff functions as an alternate channel for employees to express concerns, both on an individual and collective basis.

During the latter part of the period under consideration, the ‘Reach Out Programme’ aimed at women employees was launched. Women employees now have access to a team of women colleagues to confidentially obtain advice on personal and professional issues impacting them.

Throughout the year, continued focus was accorded to employee wellness. Regular advice on topics ranging from nutrition to exercise and mental health were disseminated. At the Annual Sports Day of the Bank, a healthy lifestyle stall was made available offering staff an opportunity to assess their BMI and fitness levels as well as obtain advice from doctors and nutritionists.

Two special fitness programmes were also conducted. In the Pedometer Challenge, volunteer staff were divided into teams and equipped with pedometers to monitor their step count. Prizes were awarded weekly to teams and individuals recording the highest step count. At the end of this two month long challenge, the leading team recording the highest weight loss was recognised and rewarded. Similarly, an intensive fitness programme, the ‘sweatshop workshop’, was also launched in January, with all participants being subjected to an extensive physical check up prior to being selected for the programme.

A programme was held for female employees of the Bank in collaboration with the Family Health Bureau giving employees an opportunity to discuss topics impacting them, including balancing career and motherhood, reproductive health, family nutrition identification, prevention of breast cancer etc.

In tandem with this, an extensive awareness campaign honouring breast cancer awareness month was carried out. Wellness packages were negotiated with hospitals at attractive discounted rates and made available to employees and their families. The programme culminated with a breast cancer awareness walkathon/runathon towards which employees contributed generously by dedicating both their time and money to the cause. The Bank matched the total contributions and donations were made towards an awareness and support programme arranged by a non-profit organisation in January 2017, for which survivors of breast cancer from across the island participated.

A fitness committee was set-up during the year, tasked with furthering employee awareness on the importance of physical and mental well-being.

Throughout the year, the weekly visits of a doctor continued to be made available to staff at the main offices of the Bank. Employees were also provided financial assistance for gym and social club memberships.

Employees were provided with ample opportunities for leisure and interaction, both individually and with their families, in 2016. The DFCC Welfare and Recreation Club organised a sports day, an overnight staff trip to Dambulla; at which 1,002 staff and their families participated, a cricket tournament in Kandy, a Christmas party for employees’ children and many other activities dispersed throughout the year.

The DFCC REDS, a very active club, was set-up several years ago with the mandate of providing Gen Y executives who join the Bank the opportunity to engage with the Bank and its culture and have a collective voice in expressing themselves. The DFCC REDS organised many activities during the year including an overnight adventure based team building programme, quiz night, blood drive, field trip and a memorable scavenger hunt. The Dance Committee organised an epic annual dance at Stein Studios at which the highest recorded number of staff participated.

Employees were also afforded the personal satisfaction of participating in many CSR initiatives during the year. The DFCC Welfare and Recreation Club and DFCC REDS Committee very successfully spearheaded relief efforts for victims of floods and landslides in affected areas. It was heartening to witness the immediate and generous monetary contributions made by employees and their selfless devotion of personal time towards relief efforts. The DFCC REDS also organised a renovation project at the Ambakolawawe Primary School. Many employees also enthusiastically contributed towards the donation programme towards raising awareness on breast cancer, which was initiated in October.

In addition, many departments and branches routinely organised diverse supplementary community projects further demonstrating the commitment of the Bank’s employees towards the betterment of society. In December, in keeping with the spirit of giving, employees contributed towards school supplies for underprivileged kids, the proceeds of which were donated to two worthy institutions in January 2017.

DFCC Bank is cognisant of the fact that successful business operations always depend on the continued support and benefits from a variety of trusted and committed partners. To that extent, the Bank has forged relationships with reputed local and global organisations. These include multilateral and bilateral development institutions, local financial institutions, Government bodies, industry associations and suppliers of goods and services. All of the aforementioned actively engage with us in our efforts to create long-term sustainable value. We share joint strategic objectives and the synergies provide greater opportunities for growth.

From its inception in 1955, on the recommendation of the World Bank, DFCC Bank has fostered resilient relationships with diverse bilateral and multilateral institutions.

Some of these institutions include the aforementioned World Bank, the European Investment Bank (EIB), Asian Development Bank (ADB), Kreditanstalt fűr Wiederaufbau (KfW), Germany, Deustche Investitionsund Entwicklungsgesellschaft (DEG), a subsidiary of KfW, Nederlandse Financierings – Maatschappij voor Ontwikkelingslanden (FMO), Netherlands and Proparco, a subsidiary of Agence Francaise de Developement (AFD), France.

DFCC Bank’s primary role within these partnerships has been; functioning as an effective credit institution for the on-lending of funds to end users, implementing credit programmes, administering grant funds and smart subsidiaries for market development, and capacity building.

DFCC Bank implemented a dedicated housing loan credit scheme funded by ADB, and was appointed as a participating bank in a USD 100 million ADB credit line for SMEs. The Bank formerly initiated the credit component of the ADB-funded Plantation Development Project (PDP) and similarly managed the Plantation Trust Fund component of the PDP in tandem with associate aid from National Asset Management Limited.

The entities DEG, FMO and Proparco promoted several efforts in developing and emerging economies. DFCC Bank possesses an ongoing loan from DEG, and both DEG and FMO were former shareholders of the Bank, and had representation on the Board.

In 2016, DFCC Bank made inroads to the Middle Eastern sector for funding requirements and currently enjoys a bilateral funding relationship with RAKBANK, also known as the National Bank of Ras Al Khaimah, of the United Arab Emirates. DFCC Bank has secured similar channels of understanding with other reputed banks and financial institutions in the region.

DFCC Bank enjoys sustained relationships with the entities listed below, in order to facilitate transactions of customers which originate in or involve foreign countries. These organisations also act as the Bank’s agents in the respective countries.

| Bank | Country |

| Commonwealth Bank of Australia | Australia |

| Commerzbank AG | Germany |

| Zurcher Kantonal Bank | Switzerland |

| Bank of China | China |

| UniCredit Bank AG | Germany |

| Bank of Ceylon (UK) Limited | UK |

| Bank of Ceylon | Maldives |

| Bank of Ceylon | India |

| Sumitomo Mitsui Banking Corporation | Japan |

| Deutsche Bank Trust Company Americas | USA |

| HSBC Bank USA N.A. | USA |

| Mashreqbank PSC | USA |

| Mashreqbank PSC | India |

| Standard Chartered Bank | USA |

| Standard Chartered Bank | Germany |

| Standard Chartered Bank | India |

| Standard Chartered Bank | Bangladesh |

| Standard Chartered Bank (Pakistan) Limited | Pakistan |

| Standard Chartered Bank | Singapore |

| HDFC Bank | India |

As per the procurement policy of DFCC Bank, the selection of suppliers and the acquisition of goods and services is done in a non-discriminatory, transparent and economically sound manner.

The selection of suppliers entails a rigorous process of evaluation paying close attention to pricing, quality, after sales support, adequate references, timely delivery and technical proficiency.

Previously registered suppliers who fail to qualify under the metrics implemented are subsequently reviewed once in every three years. DFCC Bank honours its commitment to help local communities flourish and these suppliers can receive financial advice and assistance from the Bank, if so required.

DFCC Bank works with a diverse base of reputable vendors for services such as:

The Bank also collaborates with over 500 merchants encompassing a range of industries in operating the Vardhana Virtual Wallet. These include restaurants, grocery stores, supermarkets, hotels, hospitals and specialised retail stores, all of which are fully equipped with the technology to operate Vardhana Virtual Wallet services. Further details can be found under Industry Initiatives under Value Creation and External Capital Formation section.

Lanka Money Transfer (LMT) is a cutting-edge, web-based remittance system designed by DFCC Bank and developed by the Group’s IT subsidiary, Synapsys Limited. This service is currently in the process of being deployed across the globe to establish worldwide correspondence for inward remittances to Sri Lanka, targeting migrant worker earnings. The LMT system is capable of disbursing remittance proceeds as cash payouts and account credits. However, its operation is currently focused on account credit transactions taking into consideration the need to build long-term customer loyalty/retention as well as stringent anti-money laundering policies.

LMT is being rolled out to other Sri Lankan banks and financial institutions, mainly those who do not possess an individual remittance system. These institutions can then have a straightforward arrangement with the service to receive direct remittances for their account holders, as remittance transactions received from exchange companies to LMT will be retransmitted instantly to the respective partner bank/financial institution via a secure network.

Currently, such partner banks/financial institutions include Hatton National Bank, Pan Asia Bank, the Regional Development Bank, Sanasa Development Bank, Union Bank PLC, Amana Bank, HDFC Bank, Lanka Orix Finance Limited, Sarvodaya Development Finance Limited and Citizens Development Finance PLC.

DFCC Bank introduced a revolutionary supplier settlement system that supports Sri Lanka’s well-established community of private tea manufacturers and tea leaf suppliers. The system enables suppliers to have revenues from their sales managed by a bank and be transferred directly into their bank accounts.

DFCC Bank operates the ‘V Cash Card’ as part of this initiative, enabling tea leaf suppliers to withdraw cash from over 700 ATMs nationwide. The system encourages efficiency, visibility and increased accountability, resulting in tea leaf suppliers possessing greater confidence in the collection process and control over their receipts.

With a focus on technology driven solutions, the Bank launched the Vardhana Virtual Wallet (VVW) in June 2016.

The VVW is an innovative mobile payment solution that is the first of its kind in the country’s banking industry. It serves both retail consumers and businesses, offering ease and convenience and the guaranteed assurance of safety of funds.

Once registered and upon downloading the app from the App store or Google Play, the individual user can access funds from the user’s Bank account which is linked to the VVW and use it to purchase goods and services at merchant points or at online stores, pay utility bills, and send and receive money anywhere, anytime.

Users can also use it to top up funds at selected merchant outlets or receive funds from overseas through DFCC Bank’s Lanka Money Transfer service.

Merchants across all trades can also benefit from the VVW, which enables them to accept payments for goods and services electronically; regardless of the scope of their business operation. The primary benefit is that it reduces operating costs as the transaction costs are higher when accepting other payment instruments. The VVW can be integrated at point of sales terminals if so required. Since the system can be accessed on the go, it is an ideal tool

for executing transactions that require delivery or mobile vending.

The product has rapidly captivated audiences, with increasing usage reported at both merchant and individual levels. The merchant base has expanded into large scale supermarkets, fast food chains, retail clothing chains, online stores, salons, cinemas and many more attractive places will be introduced in the near future, making the VVW the most convenient payment method.

Promotions conducted at business locations and other prominent marketing campaigns have flourished in increasing market awareness of the product whilst simultaneously increasing the number of transactions routed through the application by existing users. The application will be marketed further in 2017 through promotions, campaigns and effective cross-selling. In addition, the Bank will further refine the product by continuously adding new developments.

Through sustained growth via mindful management of its business, DFCC Bank has diversified itself through a succession of well-planned and sound strategic acquisitions, alliances and partnerships over the years and has significantly benefited from the ensuing synergies.

The DFCC Group currently comprises of its subsidiaries; DFCC Consulting (Pvt) Limited, Lanka Industrial Estates Limited, Synapsys Limited, joint venture; Acuity Partners (Pvt) Limited and the associate company; National Asset Management Limited. The combination of all these entities guarantees the provision of a range of services to the financial sector.

DFCC Consulting (Pvt) Limited was established in 2004 as a fully owned subsidiary of DFCC Bank to engage in project consultancy and related fields.

Through its shared resources model, DFCC Consulting draws upon a multidisciplinary, highly skilled resource pool of nearly 600 executive staff of DFCC Bank, as well as a pool of reputed external individuals who are experts in various fields. The company also plays a supporting role to DFCC Bank by providing expertise in the fields of environment, engineering and renewable energy.

DFCC Consulting also carries out international consultancy assignments, some of which in partnership with overseas consulting firms.

Lanka Industrial Estates (LINDEL), occupies a strategic location in Sapugaskanda on 125 acres of land. It is located in close proximity to the Colombo Harbour (at 18 km) and to the Bandaranaike International Airport (at 25 km). This industrial estate offers lands and buildings for lease and basic infrastructure to set up industries. Out of the 19 production facilities that are currently in operation, six are managed by Fortune 500 Companies. Furthermore, 95% of the leasable land has been let to industries.

Synapsys Limited was set up in 2006 as a fully owned subsidiary of DFCC Bank to provide software development, MIS solutions and IT support to DFCC Bank as well as other customers. The company has proved to be a dynamic and innovative technology firm with an array of products and services supporting Banks, Capital Markets, Insurance and Retail Payments across Asia and Pacific. The domain knowledge and skills of its employees has enabled Synapsys to originate two flagship and NBQSA award winning platforms, as well as other notable Fintech solutions.

Acuity Partners (Pvt) Limited, representing a joint venture between DFCC Bank and Hatton National Bank (HNB), is a fully-fledged investment bank. It is the only integrated, fully-fledged investment bank in Sri Lanka offering an all-inclusive range of products and services in fixed income securities, stock brokering, corporate finance, margin trading, asset management and venture capital financing.

The following subsidiaries, associates and business units fall under the umbrella of Acuity Partners:

National Asset Management Limited (NAMAL) is the pioneer Unit Trust management company in Sri Lanka established in 1991 with 25 years of experience and a successful track record of investing in equity and fixed income markets. NAMAL launched the first Unit Trust to be licensed in Sri Lanka (National Equity Fund) and the first listed Unit Trust (NAMAL Acuity Value Fund). NAMAL operates eight Unit Trusts and offers private portfolio management services.

DFCC Bank has obtained membership in or established alliances with the industry associations and organisations listed below. The Bank’s fellowship with them yields numerous opportunities for networking, along with contributing towards upholding industry standards, and in weaving a collective voice representing the industry on matters of regulation and policy.

DFCC Bank strives to ensure sustainability in terms of caring for the society and environment, having built it into its core values and strategy. Thus, the Bank uses all its resources to address any social and environmental issues in the communities in which it operates.

Moreover, employees are encouraged to engage in community development efforts and any issues and concerns regarding the society and environment can always be brought to the knowledge of the Management and the Board of Directors.

DFCC Bank has played a pivotal role in supporting economic development initiatives in Sri Lanka, since commencing operations in 1955. The Bank has transformed rural economies, enhanced livelihoods, generated employment and encouraged capital formation across every district. It remains steadfast in its commitment to advance financial inclusion through its ongoing expansion programmes, taking its product and service offerings to the rural populace of the country.

In addition to providing financial services, the Bank provides value added services for emerging communities, such as training and development programmes for entrepreneurs and SMEs.

Furthermore, whilst expanding its traditional brick and mortar structures, the Bank is focused on developing electronic mediums backed by the latest technology to provide customers with greater accessibility and the ease and convenience of conducting cashless transactions via the Vardhana Virtual Wallet.

| Province | GDP (LKR million) 2013 | Provincial % of Total GDP | DFCC Branches | DFCC’s Provincial Presence (%) | Rank Based on Total GDP |

| Western | 3,643,241 | 42 | 39 | 28.26 | 1 |

| Central | 959,918 | 11 | 15 | 10.87 | 2 |

| Southern | 954,518 | 11 | 23 | 16.67 | 3 |

| North Western | 887,083 | 10 | 12 | 8.70 | 4 |

| Eastern | 542,905 | 6 | 10 | 7.25 | 5 |

| Sabaragamuwa | 526,155 | 6 | 15 | 10.87 | 6 |